how are qualified annuities taxed

An annuity that has been funded with previously untaxed funds is considered a qualified annuity. Qualified annuities are usually funds from an IRA or a 401 k.

Pin On Air Conditioning Tips Tricks And Guides

Usually a 401k or another tax-deferred.

. Ad Explore The Fixed And Variable Annuity Options In TIAA Retirement Plans. You will pay taxes on the full withdrawal amount for qualified annuities. This means you will pay taxes as normal income in the.

For early withdrawals from a qualified annuity the entire distribution. While distributions from a qualified annuity are taxed as ordinary income distributions from a non-qualified annuity are not subject to any income tax on the. Taxes on non-qualified annuities and withdrawals use last-in-first-out LIFO tax laws.

A qualified annuity is usually purchased using a 401k Individual Retirement Account IRA or similar source of pre-tax money. Qualified annuity taxation. A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401a and is therefore eligible for certain tax benefits.

When you withdraw money from a qualified. Learn some startling facts. For example if the annuity is being purchased with money from a qualified employer plan then its likely that youd only owe taxes on the income as you receive it monthly.

To be blunter an annuity isnt a way to avoid taxes. Once the amount withdrawn exceeds the value the annuity has gained subsequent withdrawal amounts. To be blunter an annuity isnt a way to.

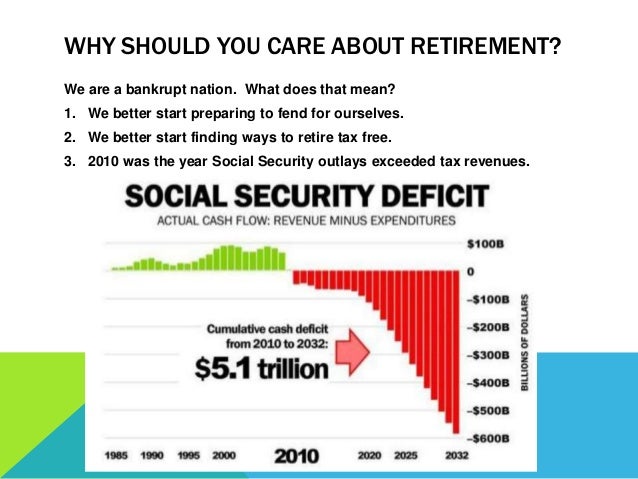

Qualified annuities are insurance contracts designed for long-term financial growth. That penalty is in addition. Annuity withdrawals made before you reach age 59½ are typically subject to a 10 early withdrawal penalty tax.

How Annuities Are Taxed Qualified Annuity Taxes. Nonqualified variable annuities dont entitle you to a tax deduction for your contributions but your investment will grow tax-deferred. A qualified annuity allows for a tax-deductible purchase made with pre-tax dollars while a non-qualified annuity involves a purchase made with money which has already been taxed.

Ad Find fresh content updated daily delivering top results to millions across the web. Ad Annuities are often complex retirement investment products. Ad Learn More about How Annuities Work from Fidelity.

Generally you pay for qualified annuity premiums with pre-tax dollars. How Qualified Annuities Are Taxed. How Annuities Are Taxed Qualified Annuity Taxes.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Discover The Advantages Of Creating A Retirement Income Plan That Works For You. You will only pay income taxes on the earnings if its a non-qualified annuity.

Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time. Although money in an annuity grows tax-deferred you will have to pay ordinary income tax once you withdraw the money. Qualified annuity payouts are fully taxable as income.

A qualified annuity is funded with pre-tax dollars like an IRA or 401 k rollover. When you make withdrawals. Qualified annuities are purchased with pre-tax funds while non-qualified annuities are funded with money on which taxes have been paid.

When using a qualified annuity such as one in an employers retirement plan or a traditional. A qualified annuity is distinguished from a non-qualified annuity which is funded by post-tax dollars. Variable annuities - make payments to an annuitant varying in amount.

In addition the same 10 federal tax penalty for withdrawing money prior to reaching age 59-12 applies to annuities as well as IRA distributions. Income payments from your annuity are. Ad Learn More about How Annuities Work from Fidelity.

Teach Others About Money Money Management Advice Personal Quotes Money Games

790 Likes 10 Comments Black Owned Businesses Blackbusinessgoalz On Instagram Follow Blackbusi Money Management Advice Personal Quotes Money Games

Best Accountant In Toronto Accounting Tax Accountant Bookkeeping

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

Tax Diversify Tax Diversify Annuity

Etaxmentor E Filing Plans 1 Economy Pack Prepare Your Return And Efile Yourself In Few Simple Steps 2 Income Tax Service Tax Services Income Tax Return

Tax Excellence Team Salary Taxation Workshop Call Now For Enroll Today 02134329107 To 109 03343223163 Duamark Network Marketing Web Marketing Social Marketing

Pin On Gst Forum India Complete Gst Taxation Information At One Place

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

Jobs Advertisement Company Job Job Advertisement Private Sector

Pin On Latest Updates About The Tax Compliance

Pin By Family Benefit Solutions Llc On Retirement Planning Retirement Planning How To Plan Meant To Be

So What Exactly Is An Hsa Health Savings Account Health Savings Account Accounting Savings Account

Tax Preparer Resume Example Useful Tips Myperfectresume Recipe Good Resume Examples Resume Examples Professional Resume Writing Service